Stock loss tax calculator

Stock Calculator You can use this handy stock calculator to determine the profit or loss from buying and selling stocks. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

How To Calculate Capital Gain Tax On Shares In The Uk Eqvista

You can also find the ROI on the investment.

. What is the dividend yield on a stock. Check out our free Capital Gains Interactive Calculator that in just one screen will answer your burning questions about your stock sales and give you an estimate of how much. Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income.

With anycalculator stock calculator the profit or loss from that trade can be calculated easy. Cost basis is the original value of an asset for tax purposes adjusted for stock splits dividends. Once youve opened it you need to provide the initial value at which the asset was bought the sale value at which you have sold it and the duration.

Use our stock calculator to calculate the profit or loss from the sale of stock. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Check out our capital gains tax calculator.

Investment returns can be expressed by subtracting the total buying cost from the total selling. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Ad With a Focus on Client Goals American Funds Takes a Different Approach to Investing.

With this stock cost basis calculator you can determine the total cost basis of your investment. Stock profitloss calculations are the key to know the actual value of returns on your investments. Calculators Investments Taxes If you sell stocks Bitcoin or a large asset such as a car or boat for a profit you may be on the hook to pay capital gains taxes on that income.

Tax filing status Does your combined income exceed 250000 if married filing jointly 125000 if married filing. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Just enter the number of shares your purchase price your selling price and the commission fees.

Compare taxable tax-deferred and tax-fere. The stock average calculator is a free online tool for calculating the average price of stocks and the average down calculator is best for averaging. This may be about twice the tax rate you pay on long-term.

A tax loss carryforward is a tax policy that allows an investor to use realized capital losses to offset the taxation of capital gains in future years. This is an online and usually free calculator. You wanna calculate something.

Calculate your profit or loss for an investment using our stock. By entering the number of shares units and share price cost per unit you can find the total. To calculate your profit or loss subtract the current price from the original price.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. What Is a Capital Loss. Use this interactive tool to see how charitable giving can help you save on taxesand how accelerating your giving with the.

Discover Helpful Information And Resources On Taxes From AARP. Capital gains and losses are taxed differently from income like wages. Ad Our Resources Can Help You Decide Between Taxable Vs.

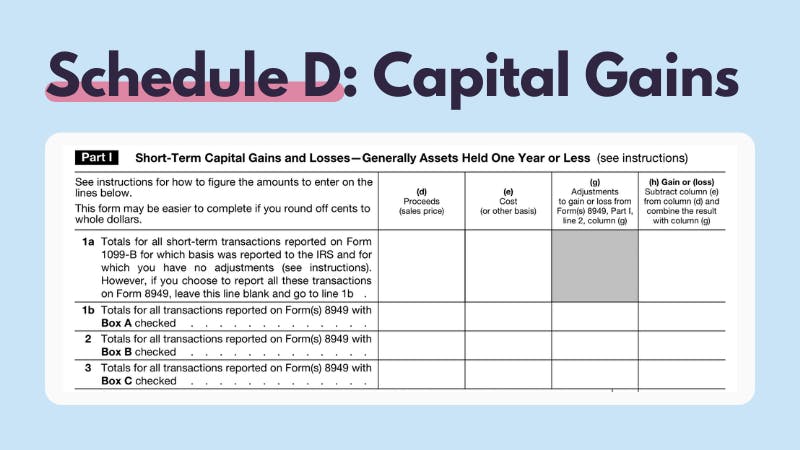

The first step in calculating gains or losses is to determine the cost basis of the stock which is the price paid plus any associated commissions or fees. An asset sold within a year of purchase is typically taxed as ordinary income 23 on average and called a short-term gainloss. Tax Loss Carryforward.

You may have a capital gain or loss when you sell a capital asset such as real estate stocks or bonds. Use this calculator to help estimate capital gain taxes due on your transactions. A capital loss occurs when you sell a capital asset for less than what you bought it for.

Charitable Giving Tax Savings Calculator. Learn More About American Funds Objective-Based Approach to Investing. It also calculates the return on investment for stocks and the break.

Long-term capital gains are taxed at lower.

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

Long Term Capital Gain Tax On Share And Mutual Fund Excel Calculation To Find Ltcg Of Mutual Fund Youtube

How Capital Gains Affect Your Taxes H R Block

Long Term Capital Gains Tax What It Is How To Calculate Seeking Alpha

Uk Hmrc Capital Gains Tax Calculator Timetotrade

Taxes On Stocks How Do They Work Forbes Advisor

Uk Hmrc Capital Gains Tax Calculator Timetotrade

Capital Gains Tax Calculator The Turbotax Blog

Capital Gains Tax 101

Capital Gains Tax What Is It When Do You Pay It

Calculating The True Benefits Of Tax Loss Harvesting Tlh

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

Uk Hmrc Capital Gains Tax Calculator Timetotrade

Irs Crypto Tax Forms 1040 8949 Koinly

Guide To Calculating Cost Basis Novel Investor

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Capital Gains Yield Cgy Formula Calculation Example And Guide